december child tax credit amount 2021

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

The maximum amount is now up to 3600 for children under age 6 as of December 31 2021 or 3000 for children ages 6 through 17.

. The enhanced child tax credit expired at the end of December. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022. Previously the child tax credit was a maximum of 2000.

Have been a US. Of the 2021 Child Tax Credit. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit. Makes the credit fully refundable. You may claim the remaining amount of your 2021 Child Tax.

How Much Were the Child Tax Credit Payments Each Month. For more information regarding how advance Child Tax Credit payments are disbursed see Topic E. Disbursed on a monthly basis through December 2021.

The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. When you file your 2021 tax return you can claim the other half of the total CTC. From July 2021 through December 2021 the IRS issued Advance Child Tax Credits up to 300 for children under age 6 and up to 250 for children ages 6 through 17.

15 and many will see up to MoreChild tax credit payments end this month but most parents are still owed up to 1800. This includes families who. Home of the Free Federal Tax Return.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line 8b plus the following amounts that may apply to you. Of up to 300child under age 6 250child ages 6 to 17. Also the final.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Unless Congress takes action the 2020 tax credit rules apply in 2022. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between the ages of 6 and 17.

Families will get the. Heres an overview of what to know. Child Tax Credit payments continue to be distributed across the United States in a bid to ease the financial burden caused by COVID-19 with November 15 the next date on which the.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per. Increases the tax credit amount. The first half of the credit is being sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when parents file their income tax returns for 2021.

Even if you dont owe taxes you could get the full CTC refund. That payment date is Dec. December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet CCB Payment Dates for 2022.

This year starting in July. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Removes the minimum income requirement.

Increases the tax credit amount. If the total is greater than the. Your newborn should be eligible for the Child Tax credit of 3600.

The 2021 CTC is different than before in 6 key ways. Claim the full Child Tax Credit on the 2021 tax return. The 2021 CTC is different than before in 6 key ways.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Your newborn child is eligible for the the third stimulus of 1400. E-File Directly to the IRS.

Eligible families can now apply for a one-time tax rebate to receive. Before that though families will see the final payment for their child tax credit advances. This means that the total advance payment amount will be made in one December payment.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

Of the amount will be paid as. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children in the USA with the. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Advance Payment Process of the Child Tax Credit. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

December 15 and. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Find COVID-19 Vaccine.

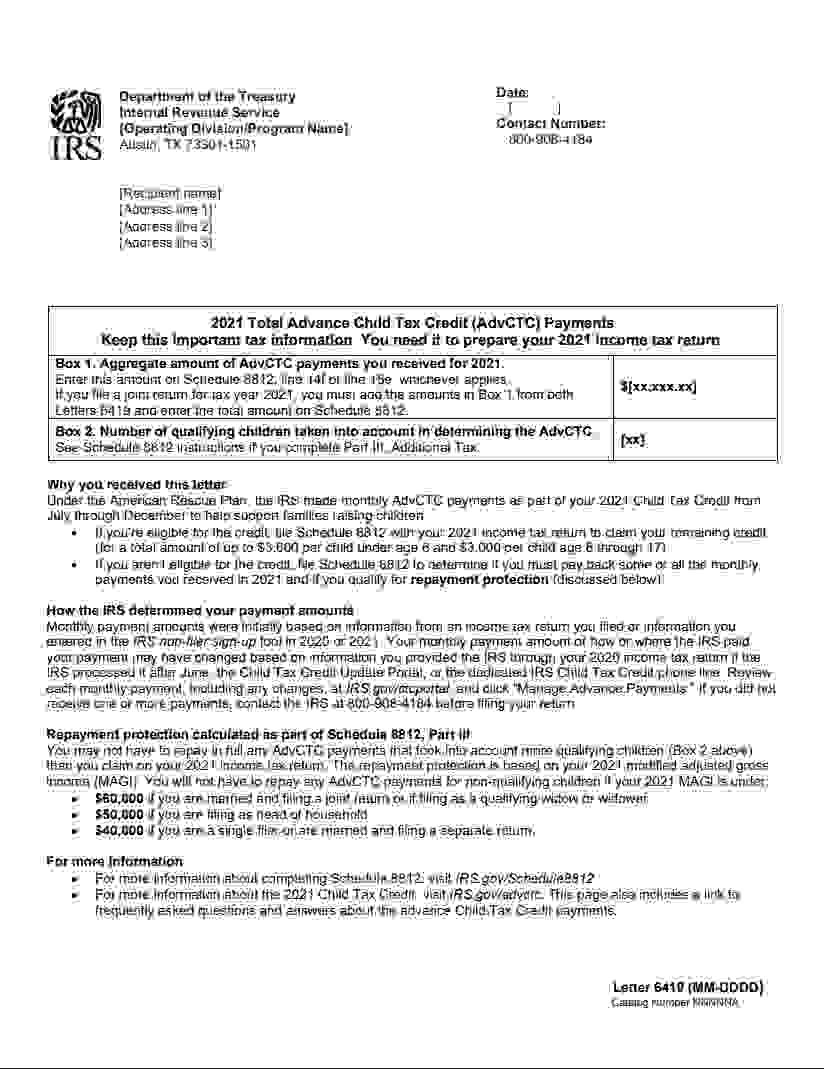

However the deadline to apply for the child tax credit payment passed on November 15. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season. December 15 2021.

The remaining 1800 will be. Learn more about the Advance Child Tax Credit.

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Where Things Stand With The Monthly Child Tax Credit Payments Npr

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

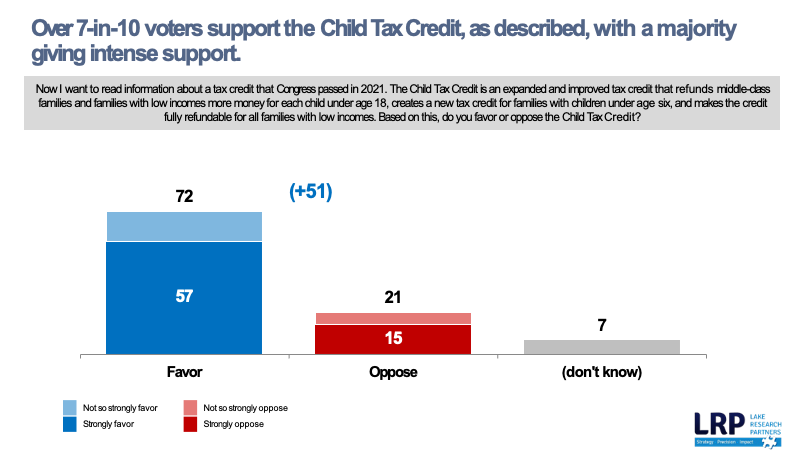

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Family Security Act 2 0 Creates Winners And Losers First Focus On Children

October S Monthly Cash Payment For Parents Is Being Sent Tomorrow Here S What You Should Know

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Child Tax Credit 2022 Are You Eligible For Money From Your State Cnet

Tax Update 2022 Child Tax Credit For Separated Or Divorced Parents High Swartz Llp Jdsupra